Surprise Medical Bills Squeeze New Yorkers

(Lauren)

By Avinoam Idhe

Many New Yorkers are finding that they are being charged for medical procedures that they thought were covered by insurance. They find out when the insurance company sends a letter saying it does not intend to pay the entire bill or when they receive a bill from a third party medical professional or a lab.

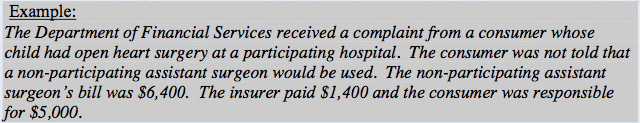

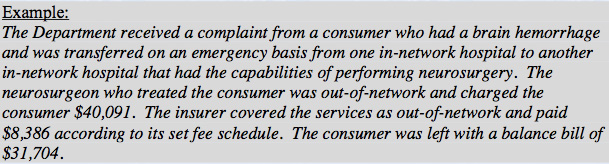

According to the New York State Department of Financial Services, consumers regularly complain to the agency that they have used in-network hospitals and doctors, but still receive bills from out-of-network providers, who the consumer did not know was out-of-network.

“Simply put, surprise medical bills are causing some consumers to go broke,” the agency says in its report, An Unwelcome Surprise: How New Yorkers Are Getting Stuck with Unexpected Medical Bills from Out-of-Network Providers. The agency says such billing is a significant cause of personal bankruptcy.

The report showed that insurers and HMOs recorded receiving 1,401 complaints related to surprise medical bills in 2010. Ninety percent of those bills were for non-emergency services. The specialty areas of the treating providers were mainly anesthesiology, lab services, surgery and radiology.

Lack of disclosure, says the agency, was a problem. “For scheduled, non-emergency medical services, consumers typically do not know: (1) many of the specialists who are reasonably anticipated to provide treatment; (2) whether those specialists are out-of-network; (3) how much those out-of-network specialists reasonably expect to charge; or (4) how much the insurer reasonably expects to cover.”

Medical billing can be a byzantine process that mystifies and intimidates patients. Frances DiSalvo knows exactly how opaque health insurance practices can leave a patient worried and scratching their heads. DiSalvo says she went in for an ambulatory surgery done in office. She was told by her insurance that the procedure was covered and she would only be responsible for the co-pay. DiSalvo later received an unpleasant surprise. “I got a bill from the office for the anesthesia for a cost of around $12,000,” she said.

Nancy DeLauro had a similar experience. She went to her primary care doctor to have blood work drawn. She thought she was only responsible for her routine co-pay. DeLauro says she was “pissed” when she received a bill from the lab which processed her blood work. DeLauro was further infuriated when she called the lab, and was told she was being billed because the lab was out of network and her insurance would not reimburse them. “I didn’t feel I was responsible” she says.

In the end, both DeLauro and DiSalvo contacted their respective providers and insurance companies and both bills were dismissed. But their dilemmas pose a bigger question: Why are some patients not being informed of exact costs of care?

Anesthesiologists, emergency room doctors, and radiologists are many times not employed by the hospitals where they practice. Many of them have separate contracts with insurance companies. This means a patient may be told that the provider they choose is covered in-network by their insurance. However, medical professionals involved, during or after the procedure, may be out-of-network for the patient’s insurance. Thus the patient is billed the out-of-network costs.

Maria Ferri worked in customer service for the Blue Cross Blue Shield Association for many years. Ferri says the first step any overbilled patient should take is to call their insurance company. “Even if the mistake stemmed from the doctor’s office, your insurance company will often step up and advocate for you to (resolve) the situation,” she says.

Providers sometimes bill patients for services not even provided, says Ferri. She says many times a doctor or hospital may submit a charge by mistake for a service that was not rendered and patients should review their bills carefully.

Patients can often find themselves caught in between payment negotiations with an insurance company and a healthcare provider. The best way to avoid overbilling says Ferri, is to contact all parties involved prior to a visit or procedure. Confirming who is covered under your insurance plan can save a patients the worries and headaches associated with surprise medical bills.