A Better Lotto for the Poor

157th and Broadway, photo by Jhonny Reyes Castro

By Jhonny Reyes Castro

Many people who play the lottery in the Washington Heights community of Manhattan are gambling beyond their means. Some players interviewed say they are almost bankrupt because they play every day. Others have lost their apartments. Resident Tatiana Gutierrez said she was worried because lost more than $6,000 in November. “My husband is angry with me because the expenses in the area are very expensive,” said Gutierrez, 37.

In November, Bronx Borough President Ruben Diaz Junior introduced a plan to reform the lottery in order to minimize the impact on low-income New York residents. In the report “Re-Orienting The Lottery: a Better Lotto For The Poor,” Diaz proposes changing the way lottery funds are distributed to benefit low-income students living in or near the poverty line. He also proposes that check cashing services be banned from selling lottery tickets and that the state educate residents about the benefits of bank accounts.

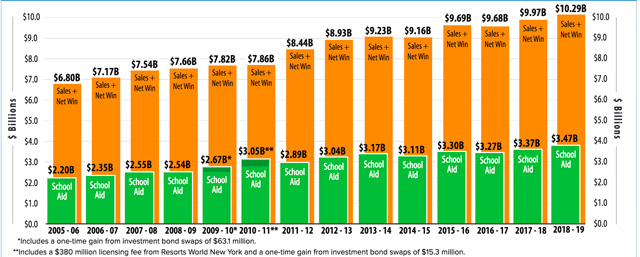

Advocates of the lottery often point to the fact that funds are spent on education. According to the New York Lottery and Gaming Commission, the New York Lottery has earned $68.13 billion since 1967 for education statewide and $3.47 billion for the fiscal year 2018-19. New York City received $1,263,968,814 for the fiscal year.

Diaz proposes shifting the way these funds are allocated, sending them to high-poverty schools, instead of to all districts across the state. “Low income communities generate much of the lottery’s revenue but they don’t receive benefits proportionate to their patronage of the system,” said Diaz Jr. “That money should be spent to support low-income students with specific programs in schools that are aimed at the alleviation of poverty in both the short and long terms.”

Washington Heights is one of the poorest communities in Manhattan but has more lottery players than wealthier neighborhoods. Many of the lottery players in the area find themselves with health, family and mental health problems, says Ulysses Contreras, who owns a license to sell New York State lottery tickets. “They are playing every day,” says Contreras. “I know people who come three and up to five times a day to play. Many of them have lost everything from the game.”

Washington Heights is one of the poorest communities in Manhattan but has more lottery players than wealthier neighborhoods. Many of the lottery players in the area find themselves with health, family and mental health problems, says Ulysses Contreras, who owns a license to sell New York State lottery tickets. “They are playing every day,” says Contreras. “I know people who come three and up to five times a day to play. Many of them have lost everything from the game.”

Henry Stayton says he lost $60,000 in a bet and another $10,000 playing the lottery. “I was bad economically six months ago,” said Stayton. “I started betting my money and playing the lottery daily, which made me more impoverished.” What came next was terrible, he said. “They took my apartment for lack of of payment and I lost a 2018 BMW.”

Bodega worker Omar Mohammad agreed that the lottery is hurting some residents. “At this time, the people are spending much more,” said Mohammad. “It is like a type of vice. They come daily with thousands of dollars to spend and most of them lose all that money.”

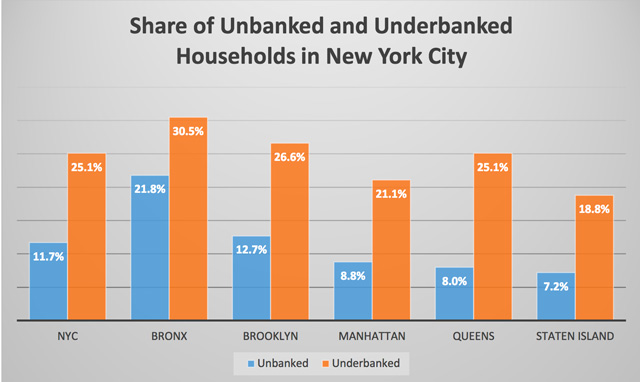

In New York City, 1.1 million residents are unbanked or underbanked, according to the Re-orienting the Lottery report. Unbanked individuals are those who don’t use banks in any capacity. Underbanked are those that may have some interactions with banks, such as a savings or checking account, but also use alternatives. Instead, many live paycheck to paycheck and have to rely on alternative means such as check cashing services, which can be more expensive. A disproportionate number are young people or minorities, according to the report.

Banning lotto sales at such establishments would reduce access and temptation, says the report. “Low-income people should not be encouraged to spend their money on the lottery at businesses that already cause them to spend more money than they would from using traditional banking services.”

What many low income New Yorkers may not realize is that there is a state law enacted in 1994 that requires banks to provide lower cost banking services. According to the office of the New York attorney general, “All banking institutions in the state, including commercial banks, savings banks and credit unions, are required to offer ‘basic banking’ accounts, commonly known as ‘Lifeline accounts’ to any and all customers.” In his plan, Diaz proposes an information campaign to bridge this “education gap.”

Frequent lotto players surveyed in Washington Heights said they tend to play more of the higher jackpot games such as the Mega Millions, Powerball, and the New York Lottery. Edwin Ortiz, 33, says he lost a lot of money playing in his younger years and eventually lost his job and family due to gambling. “I lost more than $100,000 by playing constantly,” says Ortiz. “I just could not stop playing. I know it was my fault, my actions, but I do not recommend anyone to play constantly to win a prize.”

Over the past 15 years, sales have continued to grow. (New York State Gaming Commission Year-End Review)

Saved under Entertainment, Featured Slide